#tips for budgeting

Explore tagged Tumblr posts

Text

https://543magazine.com/item-88-how-to-tie-a-bow-tie/

A bow tie is that classic, standout, in your face formal attire that will always atract attention. But HOW TO TIE A BOW TIE? Read the full blog here and get the step by step tips to Tie a Tie.

#how to set a budget#tips for budgeting#how to change a tire#tips for career#tips for self-improvement#how to tie a tie#543 magazine recipes#543 magazine travel articles

0 notes

Text

#tiktok#donald trump#fuck trump#us politics#us government#president trump#trump#trump administration#trump is the enemy of the people#trump's america#one big beautiful bill act#big beautiful bill#trump bill#trump bullshit#trump budget#no tax on tips#no tax on overtime#no tax on social security#fuck donald trump#tom suozzi#congress#us congress#crooked donald

278 notes

·

View notes

Text

Some easy witch tips

#witchcraft#witchblr#witches#witchy#dark academia#witch aesthetic#witch#witch community#witchcore#green witch#coven#Wicca#pagan#eclectic witch#eclectic wicca#easy witchcraft#on a budget#easy tips#dark feminine energy#cats familiar#sea witch#wandering witch#witch coven#witchy tips#witchythings#witchy home#witchyvibes#lilith goddess#hecate goddess#witchy woman

557 notes

·

View notes

Text

Pshh, hey. If you are in a budget or if you have to hide your practice, I have some witchy tips for you.

• You don’t need to have an altar. But if you want to, creating an altar on a wooden box is great; you can collect stuff to put in there and you can hide it under your bed.

• You don’t need crystals. Common rocks can be energised to act with a certain intention and they work just as well. You can also associate the place you got the stone/rock from with an intention, such as: a rock from a river or sea can be used for cleansing, purifying, taking energies away from you. A stone found at the property of a hospital can be used for health spells. These are vague examples, so I might make a list later on of all kinds of things you can do with mineral founding.

• Energised water is a great offering to most entities. Water holds memory and it’s easy to energise it with a certain intention if you concentrate.

• You don’t actually need candles. For many deities, an object that remembers you of them works as a taglock, an identification of the deity you’re worshipping. Besides, many spells do not need candles to work, such as: ritual baths, petitions, etc.

Have fun, and remember that your practice isn’t meant to look the same as other practitioners’. We are supposed to do things our own way, as long as it doesn’t harm anyone or anything.

#witchcraft#witch community#witchblr#witch#folk magic#pagan witch#folk witch#broom closet witch#budget witchcraft#spellcraft#spellwork#spellcasting#folk spellcraft#witch tips#witchcore#witch aesthetic#green witch#folk witchcraft#traditional witchcraft#witches

1K notes

·

View notes

Text

Become Your Best Version Before 2025 - Day 13

Financial Planning and Budgeting

Hello Goddesses! I know that talking about money, can feel scary or boring, but after working on our stress management tools yesterday, it's perfect timing to address something that's often a huge source of stress for many of us: finances.

First things first: if thinking about money makes you want to hide under your blanket, you're not alone. But taking control of your finances isn't about becoming a math genius or never buying another coffee again. It's about making friends with your money so it can help you live your best life.

Let's break this down into bite-sized pieces that won't give you a headache:

Start Where You Are

Remember when you first learned to ride a bike? You didn't start by doing tricks, you started with training wheels. Money management is the same way! First step: just look at your current situation. Open those banking apps you've been avoiding. Take a deep breath and look at your statements. Knowledge is power, even if it's a bit scary at first.

The Money Map Exercise

Grab a piece of paper (or open your notes app) and let's do something simple:

Write down all your income sources

List your regular monthly expenses (yes, including those sneaky subscriptions!)

Don't forget those irregular expenses like annual fees or seasonal costs

Look at what's left (or what's missing)

Congratulations! You've just created your first basic budget outline.

The 50/30/20 Guideline

Here's a popular way to think about your money:

50% for needs (rent, groceries, utilities)

30% for wants (fun stuff, shopping, entertainment)

20% for future you (savings, debt payment, investments)

These numbers might not work for everyone, especially depending on where you live. The important thing is to have some kind of plan that works for YOU.

Smart Money Habits You Can Start Today

The 24-Hour Rule: For non-essential purchases over a certain amount (you decide the number!), wait 24 hours before buying. You'd be surprised how many "must-haves" become "maybe nots" overnight!

Bill Calendar: Set up a simple calendar with all your bill due dates. Future you will be so grateful!

Automate Your Savings: Even if it's just $5 a week, set up automatic transfers to a savings account. It's like hiding money from yourself!

Track Your Spending: For just one week, write down every single purchase. No judging, just observing. You might find some surprising patterns!

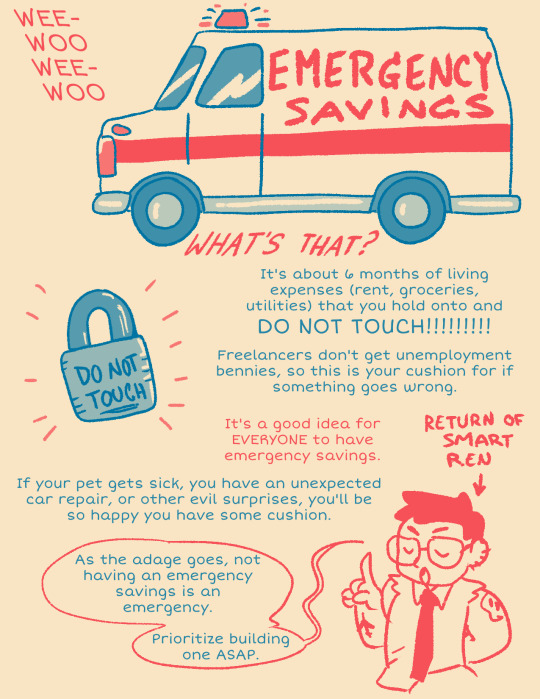

The Emergency Fund Challenge

Let's start building that safety net! Even $500 in savings can make a huge difference in an emergency. Start with a goal of saving just $25 this week. Too much? Start with $10. Too little? Make it $50. The amount isn't as important as getting started.

Money Goals That Make Sense

Instead of vague goals like "save more," try specific ones like:

Save enough for three months of basic expenses by December 2025

Pay off one credit card by summer

Create a "fun fund" for that hobby you've been wanting to try

Your financial journey is exactly that, YOURS. You don't need to compare yourself to anyone else. The person on Instagram showing off their investment portfolio might still be paying off massive debt. Focus on your own path!

Your mission for today:

Look at your bank statement (I know, scary, but you can do it!)

Pick ONE money habit from this post to try this week

Set ONE specific financial goal for 2025

See you tomorrow for Day 14! Remember, every financial decision you make today is a gift to your future self.

#personal finance#money management#budgeting tips#financial wellness#money goals#personal development#growth mindset#self love#be confident#be your best self#be your true self#become that girl#becoming that girl#becoming the best version of yourself#better version#confidence#it girl#self care#self confidence#be yourself#self worth#self improvement#self acceptance#self appreciation#girl blogger#girlblogging#girl blog aesthetic#that girl#self help#self development

86 notes

·

View notes

Note

Hey Bitches! Long-time reader, first time asker :)

I have a budgeting question!

I'm a 21 year old student living with my (employed) partner independent from both our families. I'm unemployed at the moment, but will be starting a (min wage, limited hours, career-benefiting, year-long-contracted) job starting next month. I'll also be looking into selling plasma and/or picking up a gig app to supplement the pay

I find that a lot of what makes budgets useful doesn't really work for me because most of my spending areas that can be minimized have already been minimized, and I limit and track myself so much already because I know I don't have a lot of wiggle room to spend frivolously. So most of the time, I use a spending tracker spreadsheet

However, my credit union has a built-in budget feature I like to poke around on sometimes, too. It can be nice to have a goal in mind and to feel like I did a good job at the end of the month when (most) everything is green (I was over-budget for my cat by 11 cents last month)

BUT! I can only set a budget for one month's length. This seems to be the norm and is pretty common when I look at budgeting examples

This is great for things that happen on a monthly basis (like gas, for example), where, after years of tracking my spending data, I have a solid idea of how much I can realistically expect to spend in that time. But it really sucks for things that aren't as frequent, but do happen on a regular basis (like car registration or tuition, which come once a year and every few months, respectively)

I'm kind of at a loss for how to represent or calculate these kinds of items on a budget/spending tracker (like when I'm pulling for an average over a length of time, or categorizing my spending when one value is superbly high in a sea of much smaller numbers)

Gas is about $50/month, car registration is about $100/year. I think it's a poor representation to say I need $150/month for auto expenses. I'm not spending that $100 most of the time, but I'm not expecting to pay it most of the time, so it feels wrong to say I'm saving a ton of money every month. But it also isn't great to have only $50 budgeted when registration month rolls around and I'm in the red by $100 (not to mention inconsistent maintenance of wildly varying cost)

Likewise, I wouldn't say I'm under-budget by $2,000 on the months I don't have tuition due, but it can't be correct to have a $0 budget that gets super red every three months. Dividing it up to $666 a month gets the same problem where I'm either super green, not spending anything, "saving" a ton, or very in the red, very over-budget when my tuition actually comes due. There is an option to split up payments, but it adds a $50 payment plan fee, which (in addition to generally being shitty by punishing anyone who doesn't make the lump sum) doesn't feel worth it just to make my books look nice

I've seen some recommendations to use a sinking fund for these expenses, putting money aside each month in preparation for the big expense, but

A. where exactly do you put that portion "aside" into? I have a checking, savings, (secured) credit card, and a CD account (the latter two of which I can't easily move money around in). Besides putting money into my savings account from my checking (which, when employed and receiving income, I already do), I don't understand how this works. Do people just open and have several accounts going for each expense that isn't on a monthly pattern?

And B. I'm in a fortunate enough position that I'm (just barely! Job is coming with amazing timing!) able to make single payments on these expected bigger expenses without having to meticulously save up for them. It doesn't fix my budget being wonky on months with/out these non-monthly expenses, and I would like to actually have a working budget, but do I even need to make a sinking fund if I can afford it with the habits/systems I already have?

I've also seen people using different budgets for different times. Most often, this is seasonal: a winter budget with higher heating expenses planned, a summer budget with lower heating expenses planned kind of deal. This feels closer to what I'm looking for than a sinking fund, but making a different monthly budget around each varying expense and overlapping occurrences (or lack thereof) feels cumbersome and tedious (to make, keep track of, alter, and change every month)

I could have a yearly budget, but it feels risky to go such a long time without knowing how on-track I am and my life is so in flux right now that I don't know what to expect that far into the future. Plus, like I said, I only have the option for monthly budgets in my credit union.

I expect having a more stable and higher income will help a lot (assuming I can get there). As will not having to pay for huge-stressful-chunks-of-savings-every-three-months-except-for-summertime tuition (I'll be done next year almost to the day!). I know there will still be yearly and bi-yearly expenses (and surprises) that I'll have to be ready to pay for, but I'm hoping I'll have more staggering control.

So, I've come to you, Bitches, if there is a better way to address these big, non-monthly expenses, or if I'm just missing something in one of the suggestions above, I'd be jazzed to hear about it and not have to wait to better grasp this part of my finances.

Thank you, Bitches!!

THIS IS EXACTLY WHY WE DON'T THINK BUDGETS ARE RIGHT FOR EVERYONE.

My first instinct is to tell you to ignore your bank's budgeting software. It doesn't matter. You're doing great with your personal spending tracker and you seem to have a very good hold of your expenses. So that's an option.

The other option is combining the budget with a sinking fund. Some banks will include "buckets" within your account that you can access through their online portal. For example, my Ally HYSA allows me to set up buckets within the account so I can budget for what I'm saving for our kitchen renovation, for example. It makes using a sinking fund real easy.

But not every bank has that functionality! So again, I can't stress enough how much a budget just might not be right for your situation right now.

Budgets Don’t Work for Everyone—Try the Spending Tracker System Instead

Ask Not How Much You Should Save, Ask How Much You Should Spend

Did we just help you out? Join our Patreon!

#budget#budgeting#spending money#saving money#personal finance#money#money tips#adulting#frugal#finance#money management#cash

45 notes

·

View notes

Text

how to save 101

so i recently had a poll asking what you'd do if you have $10,000, and over half of the respondents said that they'd save it for something big

if you're saving for something big — like college, a car, starting a side hustle, or even financial freedom — here's some unexpected advice that actually does something. not cute. not tiny. real.

open a HYSA (high-yield savings account) at a credit union or online bank. no, not your regular bank. they usually pay literal cents in interest. but online banks like Ally or SoFi (or your local credit union) offer 4–5% APY as of now. if you’re saving over time, that compound interest builds and beats inflation. it’s not glamorous, but it works. set it. forget it. grow.

invest in an I-Bond. you heard right — a government bond. it’s basically a super-safe investment you can buy with as little as $25. I-Bonds adjust with inflation and earn interest over time. teens can buy them through a parent or guardian's TreasuryDirect account. way better than letting your money rot in checking.

don’t save — prepay. saving up for something long-term? like a course, a trip, or even SAT tutoring? instead of stashing cash, prepay now if there’s a discount or price lock. a lot of services let you pay in advance, especially if they’re small businesses. this saves you from price hikes — and yourself.

build credit (yes, really). if you’re 18 or close to it, use $10,000 as a starter safety net for a secured credit card. this builds your credit history early — a big deal for apartments, student loans, and future jobs. make one small charge monthly (like Spotify), pay it off, never miss. boring? yes. life-changing? also yes.

micro-fund a revenue-generating skill. take that $10,000 and turn it into money. Examples:

buy a domain + hosting for a blog you monetize

invest in a course that teaches design, data entry, or UX

get supplies for a hyper-niche Etsy shop (e.g. enamel pin display boards or zines)

buy an external mic and start voiceover freelancing

a 10,000 bucks won’t change your life. but how you use it might.

#explorepage#fyp#goals#tumblr tips#saving money#helpful#poll results#useful#useful information#resources#viral#relatable content#budgeting#money#spending money#teen blog#financial advice#advice blog#real talk#self improvement#investinyourself#moneyforstudents#saveitforsomethingbig#mintconditioned

34 notes

·

View notes

Text

Just formatted this zine for print! I'm hoping to have it for C2E2 (will you be there? will I see you in Chicago?), definitely will have it at VanCAF, and later on my shop.

Until then, you can read the whole 12 page zine for free on my portfolio site, which also has the download links for PDF 🎓🤓

219 notes

·

View notes

Text

Ppssst dead bugs are free spell ingredients. Find them in the grass, in the window sill or dead in thine shower. They are indeed very useful. So many things thou may use them for dear, really. Perhaps the claws off a cicada shell for protection, parasitical and more pest like creature for cursing, moths for all sorts of whimsical purposes, insect wings for flying business and beetle shell for protection. Now off shall thee go!! To forage with thee!!! (But so be careful dear, don’t touch anything still alive or particularly spikey or colourful).

#budget witchcraft#closet witch#baby witch#witchcraft#witches#witch#witchblr#witch community#spells#spell ingredients#witch tips#nature witch#pagan witch#witch things#spell jars#spell work#spell casting

105 notes

·

View notes

Text

https://543magazine.com/skill-91-how-to-create-a-budget-2/

HOW TO CREATE A BUDGET. Gather data going out, Gather data coming in, Breakdown expenses, Total everything, Adjust, adjust, adjust... Check out the full blog here and know How to Set a Budget properly.

#how to set a budget#tips for budgeting#tips for self-improvement#543 magazine recipes#how to change a tire#543 magazine travel articles#tips for career

0 notes

Note

Best DIY Products?

It seems like every girl I know, myself included, has lash extensions. Kiss is the brand I use. I’ve used kits from Amazon in the past, but because Kiss is so accessible and easy for me to find, I stick with them. It’s very convenient to do your own lash extensions; these ones are comfortable and last forever, and they look good too. If you don’t want to pay $110+ for a fresh set of lashes, I’d strongly recommend learning how to do your own and how to customize a set. You can learn how to apply individuals, create a lash map, and maintain a set on TikTok/Insta, and I'd strongly recommend gathering lash inspiration there as well.

If wearing lash extensions isn’t your thing, then I’d recommend tinting your lashes and brows to make them pop. I tint both my lashes and my brows using Eylure products, and I’ve put most of my girls onto them as well; they come in a range of colors, they don’t stain my skin, they’re easy to apply and not at all irritating, and they’re so cheap. I would avoid using Ardell and Just For Men products (Ardell tints aren’t flattering and JFM isn’t meant for delicate facial skin) and always patch test before applying a new product to your face. I tint my lashes black and my brows dark brown, and I get a good three weeks of wear before I need to tint again and redo my lashes and eyebrows.

Nails are another major part of the equation, and the girls in my dorm either do press-ons, acrylics, or gels. It’s easy to prep your nails and use press-ons, and Kiss makes a really good line of French nails. These are the most popular nails in my dorm; they’re always sold out when I go to Ulta or Target near my campus, and they look really good when properly applied and maintained. I have acrylics on, but these were my go-to when I did press-ons; they lasted up to four weeks with proper care and maintenance, and I found that they were just as durable as my acrylics. I would recommend using a clear gel top coat, prepping your nails, and oiling your cuticles daily to help your press-ons last, and I’d watch a tutorial to see how to apply them before leaping in.

#richarlotte x#hypergamy#leveling up advice#leveling up tips#hypergamous heaux#hypergamy advice#hypergamy tips#hypergamous woman#black women in leisure#black women in luxury#the collegiate 10#hypergamous mindset#hypergamyblr#hypergamy journey#hypergamous lifestyle#hypergamous#leveling up journey#leveled up mindset#looksmaxxing#leveling up#leveled up black woman#leveled up woman#social climbing#becoming an it girl#becoming her#becoming that girl#leveling up on a budget#splendida#vindicta#diabla

73 notes

·

View notes

Text

https://apnews.com/article/cbo-trump-tax-cuts-budget-deficit-355a929637110adf1712df882360a995

#trump#republicans#donald trump#republican#conservatives#gop#us economy#u.s. economy#national debt#trump budget#budget#deficit#no tax on overtime#no tax on tips#tax the rich#cbo#money

20 notes

·

View notes

Text

Washing your face? Cleansing.

Exfoliating? Banishment.

Moisturizing? Charging.

#witch tip#witchcraft#spellcraft#sigils#witchblr#witchy vibes#budget witchcraft#witchcraft 101#cleansing#banishment#easy way to cleanse and protect before a ritual? or just before your day starts

341 notes

·

View notes

Text

Did you know incense are an easy and on a budget way to practice witchcraft?

#witchcraft#witchblr#witches#witchy#dark academia#witch aesthetic#witch#witch community#witchcore#green witch#on a budget#easy witchcraft#witch coven#kitchen witch#witchy home#witchy tips#beginner witch#baby witch#eclectic witch#eclectic wicca#wichy vibes#witchywonders#witchythings#magical#paganblr#pagan wicca#pagan witch#witches life#lilith#hecate

553 notes

·

View notes

Text

Tips for broke witches with a budget of 10$/€:

As someone who started with their craft when they were younger, living in a poor household with little to not money for me available, I know how how it is with a budget so low, that being a "true witch" seems impossible.

Well, I just need to remind you all that for practicing witchcraft, you do NOT NEED everything expensive. In fact you only need so little. Sure, the whole witch aesthetic with all the decorations, the cauldrons etc. looks lovely and most of us would really like to achieve that level of perfectionism, but Witchcraft is much more than that. It is a predominately Pagan practice. Nature is one of the biggest, if not the biggest aspect in it. Sometimes you just aren't really knowledgeable about all the options you're available to.

Tip 1: Nature walks:

As mentioned above, Nature is a big aspect. Almost every ingredient and spell componement is seen outside. Take a walk, go into the woods, get off path, you'll find herbs, fruits, flowers, all kinds of decorations. You can find sticks, bind them in any shape and hang them onto your wall. You can cut off (with Natures permission!) Ivy wreaths and hang them up. Pinecones, pineneedles, treebarks, hazelnuts, feathers, wheats all kinds of grass, everything is out there! Take a look on the ground and maybe you'd be lucky to find a few gemstones (yes, they're just out there!) or if animal bones are something for you even that!

Tip 2: Grimoire/Book of Shadows:

Your witchy journal does NOT have to be that expensive leather bound, old journal that the old antique shop sells for 60 dollars because it has a "magical aura". Yes, how can someone pass on that aesthetic, but your book isn't magick by itself. YOU first put the energy into it and make it something magical to you. Without your journaling and time you've spent, it is JUST a book! Therefore a simple notebook that costs like 1.50 max works completely fine! Mine is a notebook if found in my drawer that has a rainbow reflecting surface, trust me, the aesthetic is the thing you should be least concerned about.

Tip 3: Divination Board:

Self-made is always the cheapest option! Again, like your Grimoire, the board isn't the one with with the magical attributes. It's all you! My first divination board was made out of cardboard paper. You have all the options open, it can just be paper or you could even print one out. The material does not devalue the magical properties.

Tip 4: Pendulum:

A pendulum itself is cheaper than you think, look in the right places and you'll see. But if that is too much you can always make one yourself. You have to keep in mind that the item doesn't come with the magic! You're the one making if something magical. Find a pretty stone on the ground (with luck a gemstone!), tie it to a string and wear it as necklace. There you have it!

Tip 5: Cauldron:

A fire bowl, a normal bowl, a plastic bowl etc.! You can use anything. It depends however on what you do with it. Make sure not to use fire irresponsibly if you plan on burning something in it. Keep a window open and don't burn something in a not substitutional material. There's a reason a fire bowl is differencated from a normal bowl.

Tip 6: Gold, Bronze, Silver etc.

This goes for jewelry, tableware, bowls etc. For example in spells/rituals or offerings to a deity. A plate to put your offerings on or to set the spell on. Look into your cupboards! A glass bowl is a popular one to use since it's neutral in it's symbolic and easy to clean. If you'd prefer something golden or any other other material, ask a grandparent or maybe even parent. They usually have some sort of old tableware that is golden or bronze or anything else. If asked (and you're a closet witch!) tell them it's for decoration or putting a candle on it. The same goes for jewerly. Grandparents (or aunts!) usually have old necklaces and earrings they don't need anymore. Or even brooches with imagery you can connect to a deity maybe.

Tip 7: Tarot Cards:

It depends if you believe in the rule that says you cannot buy yourself a tarot deck. I do! Therefore what I did, was make my own one. It took lots of days but in the end I had a full deck! It's lots of work so if you don't want all that from the start, make yourself only the major arcana. Again it can be made out of cardboard, paper etc. The material really doesn't matter. If you're not familiar with the rule, it says your first tarot deck has to be gifted to you, found, or made by yourself. Infact in my case, all three happened to me!

In conclusion, Nature has ALL kinds of componements. You can find so many things all around you if you just look close enough!

But don't forget, cleansing is important! If you take items off the ground out and about, cleanse them off any negative energy before putting them into your household. If anything you need to know I haven't mentioned, just ask.

Happy witching!

#deity work#witchcraft#pagan witch#paganism#pagan#greek gods#deity worship#witch community#tips#nature#spellwork#divination#dionysus#magick#grimoire#hellenic pagan#witches#deities#deity#hellenic deities#budget witchcraft

136 notes

·

View notes